LIC Jeevan Akshay Plan:

LIC’s Jeevan Akshay VI (Plan No: 189) is a pension plan, which provides monthly pension throughout the life on payment of single lump sum amount. This is an immediate Pension plan that enables starting of immediately pension on the purchase of this policy. There are 10 different options which are available in which pension can be received. The maturity of Endowment plans e.g. Jeevan Anand or New Endowment plan can be used to buy this plan at maturity. A person can plan such that, at the age of 55 or 60 he buys this plan and enjoy his retirement with the regular pension for the lifetime. You may calculate pension using the Pension Calculator as per your one-time single amount and pension starts.

LIC Jeevan Akshay 6 Plan Review:

LIC Jeevan Akshay VI Policy is a Single Premium Immediate Annuity Plan

How it works – You pay a Single Premium (also called the 'Purchase Price') to purchase an Annuity. LIC will then pay you regular amounts for the rest of your life. You could receive this regular payout monthly, quarterly, half-yearly or annually. This regular payout amount is called an Annuity. You have 7 options to decide on the type and amount of annuity you want to receive.

Our take – If you have already purchased a Pension Plan (also called Deferred Annuity plan) from LIC you will have to buy an Annuity from LIC itself. As per the current regulations, at Vesting Age you can withdraw a maximum of 1/3 of the accumulated amount and the rest has to be used to purchase an Annuity from the same insurance company. So it is best to decide which of the 7 options best suits you. The details of the 7 Annuity options and the benefits are explained below.

You can of course by an Annuity by investing a lump sum which you have as savings. You will then be assured of a regular payout as long as you are alive. It works well for those who want a confirmed amount for the rest of their lives and are not necessarily looking at options which may offer them higher returns with an element of unpredictability. For example, there may be a period where Fixed Deposits offer better returns than the Annuity, but then the FD rates may go down also within a year or so.

Key Features:

- Single premium and immediate pension.

- Retirement Planning.

- 10 different methods for getting the pension.

- Option to secure the pension for the spouse.

- Option for the guaranteed pension for a fixed period.

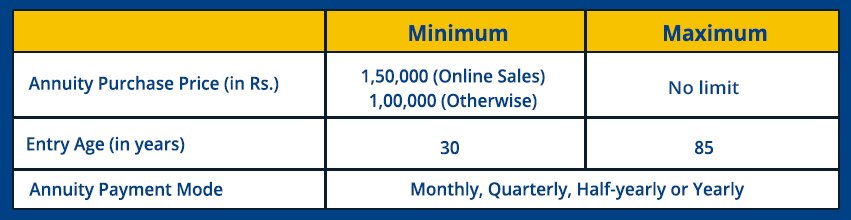

Plan Parameters

| Minimum Age at entry | 30 Years (completed) |

|---|---|

| Maximum Age at Entry | 85 years (completed) |

| Minimum Single Premium | 1,00,000 (No Maximum Limit) |

| Medical requirement | Not required |

| Mode of Pension | Yearly, Half-yearly, Quarterly, Monthly |

| Surrender | Not Applicable |

Pension Options:

One of the following options may be selected at the time of buying plan and the same cannot be changed in the future.

| Option | How Pension will be Received | What will happen in case of death |

|---|---|---|

| 1 | Pension payable for life at a uniform rate. | Pension Stops. |

| 2 | Pension payable for 5 years guaranteed and thereafter as long as the Policyholder is alive. | 1. Death during a guaranteed period, the pension is paid to nominee till the end of the guaranteed period. 2. On death after the guaranteed period, pension stops. |

| 3 | Pension payable for 10 years guaranteed and thereafter as long as the Policyholder is alive. | |

| 4 | Pension payable for 15 years guaranteed and thereafter as long as the Policyholder is alive. | |

| 5 | Pension payable for 20 years guaranteed and thereafter as long as the Policyholder is alive. | |

| 6 | Pension for life with return of purchase price on death of the Policyholder. | Pension stops and paid amount returned to the nominee. |

| 7 | Pension payable for life increasing at a simple rate of 3% p.a. | Pension stops. |

| 8 | Pension for life with a provision of 50% of the Pension payable to spouse during his/her lifetime on death of the Policyholder. | 50% of pension amount to spouse (wife or husband) for the lifetime. |

| 9 | Pension for life with a provision of 100% of the Pension payable to spouse during his/her lifetime on death of the Policyholder. | 100% of pension amount to spouse (wife or husband) for the lifetime. |

| 10 | Pension for life with a provision of 100% of the Pension payable to spouse during his/ her lifetime on death of Policyholder. The purchase price will be returned on the death of the last survivor. | 100% of pension amount to spouse (wife or husband) for a lifetime and on the death of the spouse (wife or husband) purchased amount is returned to the nominee. |

Annuity Options in Jeevan Akshay VI Plan:

There are 7 Annuity Options in this plan.

We will explain each option with the following example:

We will explain each option with the following example:

One time payment (Purchase Price) = Rs. 5,00,000 (5 lakhs) with the pension starting in Annual mode at the age of 60 years.

Option 1 - Annuity for Life: where the pension is paid till the policyholder is alive. The pension received regularly is uniform and does not change.Example: The policyholder would receive an annual pension of Rs. 48,750 for the rest of his/her lifetime.

Option 2 - Annuity Guaranteed for Certain Periods: where the pension is definitely paid for 5/10/15 or 20 years as chosen, whether the policyholder is alive or not during this period. Post this period, the pension is paid as long as the annuitant is alive. Hence this option will have 4 effective options:

Annuity Guaranteed for 5 years - Example: The policyholder or the nominee will get Rs. 48,300 surely for 5 years, irrespective of the policyholder's survival for 5 years. In case the policyholder survives for 5 years, he/she would continue to get Rs. 48,300 for the rest of his/her lifetime.

Annuity Guaranteed for 10 years - Example: The policyholder or the nominee will get Rs. 47,300 surely for 10 years, irrespective of the policyholder's survival for 10 years. In case the policyholder survives for 10 years, he/she would continue to get Rs. 47,300 for the rest of his/her lifetime.

Annuity Guaranteed for 15 years - Example: The policyholder or the nominee will get Rs. 45,950 surely for 15 years, irrespective of the policyholder's survival for 15 years. In case the policyholder survives for 15 years, he/she would continue to get Rs. 45,950 for the rest of his/her lifetime.

Annuity Guaranteed for 20 years - Example: The policyholder or the nominee will get Rs. 44,400 surely for 20 years, irrespective of the policyholder's survival for 20 years. In case the policyholder survives for 20 years, he/she would continue to get Rs. 44,400 for the rest of his/her lifetime.

Option 3 - Annuity with Return of Purchase Price on Death: pension is paid till the policyholder is alive and the “Purchase Price” or the amount initially invested is paid to the nominee as the death benefit.

Example: The policyholder would receive an annual pension of Rs. 37,550 for the rest of his/her lifetime. Post the policyholder's death, the nominee will receive the Purchase Price of Rs. 5,00,000 and policy are terminated.

Option 4 - Increasing Annuity: pension is paid till the policyholder is alive at an increasing simple rate of 3% per annum.

Example: The policyholder would receive an annual pension of Rs. 39,650 for the first year. The annual payout will increase by Rs. 1,190 (3% of Rs. 39,650) every year for the rest of his/her lifetime.

Option 5 - Joint Life Last Survivor Annuity with 50% for Spouse: pension is paid till the policyholder is alive. On the death of the policyholder, 50% of the pension is payable to a spouse for his/her lifetime. All benefits stop on the death of the spouse also.

Example: The policyholder would receive an annual pension of Rs. 45,200 for the rest of his/her lifetime. After the death of the policyholder, the spouse will be paid Rs. 22,600 (50% of Rs. 45,200) for the rest of his/her life.

Option 6 - Joint Life Last Survivor Annuity with 100% for Spouse: pension is paid till the policyholder is alive. On the death of the life insured, 100% of the pension is payable to the spouse for his/her lifetime. All benefits stop on the death of the spouse also.

Example: The policyholder would receive an annual pension of Rs. 42,150 for the rest of his/her lifetime. After the death of the policyholder, the spouse will be paid Rs. 42,150 (100% of Rs. 42,150) for the rest of his/her life.

Option 7 - Joint Life Last Survivor with Return of Purchase Price: pension is paid till the policyholder is alive. On the death of the policyholder, 100% of the pension is payable to the spouse for his/her lifetime. The purchase price is returned on the death of the policyholder and the spouse.

Example: The policyholder would receive an annual pension of Rs. 37,050 for the rest of his/her lifetime. After the death of the policyholder, the spouse will be paid Rs. 37,050 (100% of Rs. 37,050) for the rest of his/her life. On the death of the spouse, the Purchase Price of Rs. 5,00,000 will also be returned.

Once any of the above Options are chosen, it cannot be changed. So please be careful at the very beginning.

Our thoughts on the pension rates – If you are older, the payouts are obviously higher as the company would need to pay you for a lesser period of time.

Now Option 3 can be considered similar to how Fixed Deposits work as the Invested Amount (or Purchase Price) will be returned to the nominee. Depending on your age, you are offered a rate of return between 6.9% to 7.5%. Now, this is lower than the rate of return offered on FDs. However, the rates on FDs are for periods often less than 5 years. There is no guarantee of always getting better rates on FDs. You may find the rate of FDs going lower also over a period of time. In case you buy an Annuity, these uncertainties are taken care of. So it is a good option for those looking for certainty and wanting to lock down the returns which they are expecting for their golden years.

Eligibility conditions and other restrictions in LIC Jeevan Akshay VI plan:

When will you start getting your pension :

Depending on the Payment mode selected you will receive your payments are followed:

| Monthly Mode | 1 month after purchase of Annuity |

| Quarterly Mode | 3 months after purchase of Annuity |

| Half Yearly Mode | 6 month after purchase of Annuity |

| Yearly Mode | 1 year after purchase of Annuity |

To elaborate further with an example: If you take any of the 7 Options for receiving the pension in Monthly mode - you will start receiving the pension from the next month itself. If you choose to receive the pension in Quarterly mode - you will start receiving the pension after 3 months. If you choose to receive the pension in Half Yearly mode - you will start receiving the pension after 6 months. And if If you choose to receive the pension in Yearly mode - you will start receiving the pension after 1 year. This does not depend at the age on which you have taken Jeevan Akshay plan.

Tax Benefits in LIC Jeevan Akshay VI:

The premiums paid by you are exempt from Income tax under Section 80 C.

The regular pension received by you is however taxable.

The regular pension received by you is however taxable.

What happens if…

You want to surrender the policy – Under most options of this plan, there is no Surrender Value. Which means, there is no option to get back the lump sum amount you have invested. When this plan was launched, there was absolutely no option to surrender. However, some changes have been made and you can get a Surrender Value if you have chosen the "Return of Purchase Price" option in this plan and meet some other conditions. They are as follows:

- You have shifted permanently to another country of residence

- You have been diagnosed with some critical illness

You want a loan against your policy – Loan facility is not available under this policy.

CLICK HERE TO KNOW YOUR PENSION:

PREMIUM CHART:

VIDEO TUTORIAL:

No comments:

Post a Comment