LIC Cancer Cover Plan - Table No. 905:

This is a fixed benefit health plan offering payouts for the treatment of cancer. In case the customer is diagnosed with cancer, this plan will offer benefits irrespective of the costs incurred in the treatment. LIC Cancer Cover provides protection in case of Early Stage and Major Stage Cancer.

LIC is launching another health insurance related plan called LIC Cancer Cover (Plan 905) on 14th Nov 2017. This is such second health insurance product launched by LIC. Let us see it’s features, benefits, and review.

Many of you may not aware that LIC also offering one health insurance plan. I already wrote about this plan. Please refer the same at “Jeevan Arogya-Do you know this LIC’s Health or Medical Insurance Policy?“. This plan is a comprehensive health insurance plan.

Now LIC is launching a disease-specific health insurance plan. This is called LIC Cancer Cover (Plan 905). This is a non-linked (traditional), regular premium payment health insurance plan which provides fixed benefit in case the Life Assured is diagnosed with any of the specified stages of Cancer during the policy term (subject to certain terms and conditions).

Eligibility:

First, let us look at the eligibility conditions to buy this product.

You noticed that the maximum coverage is Rs.50,00,000 only. Also, the maximum entry age is 65 years. You can buy this plan ONLINE. Policy can be assigned under as per Sec 38 of Insurance Act 1983.

Options:

This product offers you two types of Sum Assured options. Also, your premium varies based on the option you choose. You have to choose this option at the time of buying this plan.

Option I – Level Sum Insured

The Basic Sum Insured shall remain unchanged throughout the policy term. Hence, the premium will also remain the same throughout the policy period.

Option II – Increasing Sum Insured

The Sum Insured increases by 10% of Basic Sum Insured each year for the first five years starting from the first policy anniversary or until the diagnosis of the first event of Cancer (whichever is earlier). On diagnosis of any specified cancer, all the claims payable shall be based on the Increased Sum Insured at the policy anniversary coinciding or prior to the diagnosis of the first claim and further increases to this Sum Insured will not be applicable

Hence, if you choose this second option, then the premium will not remain the same throughout the policy period.

Benefits:

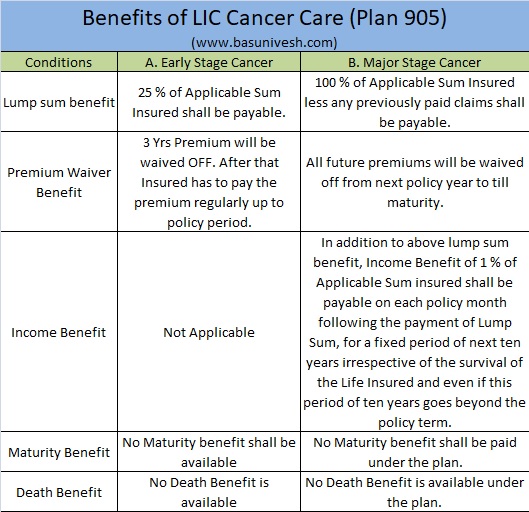

The benefits under LIC Cancer Cover (Plan 905) is divided into two stages. Do remember that this is disease specific. Hence, if you suffer CANCER disease during the policy period, then only you will get the benefits.

There is no Surrender Value, No Loan Facility, and No maturity benefit. There are two classifications of benefit.

1. Early Stage Cancer

Benefits payable on the first diagnosis of any one of the specified Early Stage Cancers, provided the same is admissible are as below.

(a) Lump sum benefit-25% of Applicable Sum Insured shall be payable.

(a) Lump sum benefit-25% of Applicable Sum Insured shall be payable.

(b) Premium Waiver Benefit– Premiums for next three policy years or balance policy term whichever is lower, shall be waived from the policy anniversary coinciding or following the date of diagnosis.

c) After 3 years premium waiver, insured has to pay the premium regularly up to the policy period.

Early Stage Cancer Benefit shall be payable only once for the first ever event and Life Assured shall not be entitled to make another claim for the Early Stage Cancer of same or any other cancer. However, the coverage for the Major Stage Cancer under the policy shall continue until the policy terminates.

2. Major Stage Cancer

Benefits payable on the first diagnosis of the specified Major Stage Cancer, provided the same is admissible are-

(a) Lump Sum-100% of Applicable Sum Insured less any previously paid claims in respect of Early Stage Cancer shall be payable.

(b) Income Benefit-In addition to above lump sum benefit, Income Benefit of 1% of Applicable Sum Insured shall be payable on each policy month following the payment of Lump Sum, for a fixed period of next ten years irrespective of the survival of the Life Insured and even if this period of 10 years goes beyond the policy term. In case of death of the Life Assured while receiving this Income Benefit, the remaining payouts, if any, will be paid to his/her nominee.

(c) Premium Waiver Benefit-All the future premiums shall be waived from the next policy anniversary and the policy shall be free from all liabilities except to the extent of Income Benefit as specified above.

Once a Major Stage Cancer Benefit is paid no payment for any future claims under Early Stage Cancer or Major Stage Cancer would be admissible.

If the life assured claims for different stages of the same Cancer at the same time, the benefit shall only be payable for the higher claim admitted under the policy.

If there is more than one Cancer diagnosed in an event, the Corporation will only pay one benefit. That benefit will be the amount relating to the stage of Cancer which has the highest benefit amount.

I will explain you the same in detail from below the table.

You may feel somewhat confused by referring above table. Let me explain the same using the below image.

Do remember one thing again. THERE IS NO MATURITY VALUE, NO SURRENDER VALUE AND THIS POLICY IS NOT ELIGIBLE FOR LOAN.

Tax benefits:

The Premium you pay towards this plan will be eligible for deduction under Sec.80D up to Rs.55,000 per year. Do remember that you will not be eligible to claim the benefits of premium paid under Sec.80C. (To know more about Sec.80D, refer my post “Tax Savings options other than Sec.80C for FY 2017-18“.

Review of the Premium:

Premium calculated will remain unchanged up to 5 years ONLY. After 5 years premium may change according to the claim experience of LIC and if changed, it will then remain unchanged for next 5 years. (Any revision in premium will be calculated according to entry age of proposer at the date of commencement of the policy)

Definitions of the Cancer covered:

I. Early Stage Cancer-

The diagnosis of any of the listed below conditions must be established by histological evidence and be confirmed by a specialist in the relevant field.

# Carcinoma-in-situ(CIS)

Carcinoma-in-situ means the presence of malignant cancer cells that remain within the cell group from which they arose. It must involve the full thickness of the epithelium but does not cross basement membranes and it does not invade the surrounding tissue or organ. The diagnosis of which must be positively established by microscopic examination of fixed tissues.

Carcinoma-in-situ means the presence of malignant cancer cells that remain within the cell group from which they arose. It must involve the full thickness of the epithelium but does not cross basement membranes and it does not invade the surrounding tissue or organ. The diagnosis of which must be positively established by microscopic examination of fixed tissues.

# Prostate Cancer–early stage

Early Prostate Cancer that is histologically described using the TNM classification as T1N0M0 with a Gleason Score 2 (two) to 6 (six).

Early Prostate Cancer that is histologically described using the TNM classification as T1N0M0 with a Gleason Score 2 (two) to 6 (six).

# Thyroid Cancer – early stage

All thyroid cancers that are less than 2.0 cm and histologically classified as T1N0M0 according to TNM classification.

All thyroid cancers that are less than 2.0 cm and histologically classified as T1N0M0 according to TNM classification.

# Bladder Cancer – early stage

All tumors of the urinary bladder histologically classified as TaN0M0 according to TNM classification.

All tumors of the urinary bladder histologically classified as TaN0M0 according to TNM classification.

# Chronic lymphocytic Leukaemia – early stage

Chronic Lymphocytic Leukaemia categorized as stage 0(zero) to 2 (two) as per the Rai classification.

Chronic Lymphocytic Leukaemia categorized as stage 0(zero) to 2 (two) as per the Rai classification.

# Cervical Intraepithelial Neoplasia

Severe Cervical Dysplasia reported as Cervical Intraepithelial Neoplasia 3 (CIN3) on cone biopsy.

Severe Cervical Dysplasia reported as Cervical Intraepithelial Neoplasia 3 (CIN3) on cone biopsy.

II. Major Stage Cancer-

A malignant tumor characterized by the uncontrolled growth and spread of malignant cells with invasion and destruction of normal tissues. This diagnosis must be supported by histological evidence of malignancy. The term cancer includes leukemia, lymphoma, and sarcoma.

Exclusions from all early-stage cancer benefits

# All tumors which are histologically described as benign, borderline malignant, or low malignant potential

# Dysplasia,intra-epithelial neoplasia or squamous intraepithelial lesions

# Carcinoma-in-situ of skin and Melanoma in – situ

# All tumors in the presence of HIV infection are excluded

# Dysplasia,intra-epithelial neoplasia or squamous intraepithelial lesions

# Carcinoma-in-situ of skin and Melanoma in – situ

# All tumors in the presence of HIV infection are excluded

Exclusions from all major-stage cancer benefits

A malignant tumor characterized by the uncontrolled growth and spread of malignant cells with invasion and destruction of normal tissues. This diagnosis must be supported by histological evidence of malignancy. The term cancer includes leukemia, lymphoma, and sarcoma. The following are excluded from major stage cancer benefits.

# All tumors which are histologically described as carcinoma in-situ, benign, premalignant, borderline malignant, low malignant potential, neoplasm of unknown behavior, or non-invasive, including but not limited to Carcinoma-in-situ of breasts, Cervical dysplasia CIN-1, CIN-2, and CIN-3.

# Anynon – melanoma skin carcinoma unless there is evidence of metastases to lymph 4 nodes or beyond;

# Malignant melanoma that has not caused invasion beyond the epidermis;

# All tumors of the prostate unless histologically classified as having a Gleason score greater than 6 or having progressed to at least clinical TNM classification T2N0M0

# All Thyroid cancers histologically classified as T1N0M0 (TNM Classification) or below;

# Chronic lymphocytic leukemia less than Rai stage 3

# Non-invasive papillary cancer of the bladder histologically described as TaN0M0 or of a lesser classification,

# All Gastro – Intestinal Stromal Tumors histologically classified as T1N0M0 (TNM Classification) or below and with the mitotic count of less than or equal to 5/50HPFs;

# All tumors in the presence of HIV infection.

Waiting Period :

A waiting period of 180 days will apply from the date of issuance of policy or date of revival of risk cover whichever is later, to the first diagnosis of “any stage” cancer. “Any stage” here means all stages of Cancer that occur during the waiting period. This would mean that nothing shall be paid under this policy and the policy shall terminate if any stage of Cancer occurs:

- At any time on or after the date of issuance of the Policy but before the expiry of 180 days reckoned from that date; or

- Before the expiry of 180 days from the Date of Revival.

Survival Period:

No benefit shall be payable if the Life Assured dies within a period of 7 days from the date of diagnosis of any of the specified Early Stage Cancer or Major Stage Cancer. The 7 days survival period includes the date of diagnosis. The benefit under this plan shall be payable subject to fulfilling all of the below criteria:

- 7 days survival period from the date of diagnosis

- Signs and symptoms relevant to cancer should have been present and documented before death

- All investigations to confirm the diagnosis of cancer should have been done before the death of the insured.

- Satisfaction of the cancer definition as per the policy condition

Review:

- The biggest advantage to save the cost is, customers can buy this plan ONLINE. By purchasing it online, you can save the premium (7% of Tabular Premium).

- The premium will be less as this product acts like typical term life insurance where there will not be any maturity benefit, surrender value, paid-up value or loan value. Only in the case of event happening (in this product if you suffer due to cancer), insured will get the benefit.

- In case of identifying the major stage cancer, the benefits are much much better. Because you no need to pay the future premiums, 1% of applicable sum assured will be payable for the next 10 years (irrespective of the term of the policy left).

- Premium changes every 5 years. Hence, unlike endowment or money back plans where the premium remains constant, here the premium will alter based on the claim experience of LIC. Hence, if the premium is not affordable after 5 years, then you will end up with cancer cover.

- There are 180 days waiting period. Hence, the risk will not start immediately after buying the policy.

- Survival period of 7 days also applies to this policy.

- In case of increasing sum assured, even though your sum assured will increase each year by 10%, but such increase is restricted to “for first five years starting from the first policy anniversary or until the diagnosis of the first event of Cancer, whichever is earlier”. Hence, it will not benefit you in long run. You have to again buy one more such policy after such 5 years over to cover the cost of cancer treatment at that time.

- This is exactly like term life insurance but disease-specific. Hence, if you do not suffer from cancer during the policy period, then you will not get any policy benefits like typical endowment or money back plans.

- NO TPA involved here. Hence, the claim may be bit cumbersome and sometimes depends on how the concerned official will take it forward.

- Tax benefits under Sec.80D BUT not under Sec.80C.

- There are many cancer-specific insurance products available from general insurance companies. I am not sure why LIC entered into this field.

- A normal person finds it hard to understand the exclusions. Hence, hard for common man to relieve that they are protected from cancer disease.

- You can’t buy it for your family like general insurers provides you. You have to buy individually. This may create managing multiple plans and also cost may shoot up.

- If there is more than one Cancer diagnosed in an event, the Corporation will only pay one benefit. That benefit will be the amount relating to the stage of Cancer which has the highest benefit amount. This I think a hindrance to this product also.

- Also, early-stage cancer can be claimed ONLY ONCE during the policy period.

No comments:

Post a Comment